TBH: Bitcoin Vs. Motley Fool Who Wins (Update #10 Q2 Year 3)

Background

This is the second quarter update of year three of this experiment the 10th overall update since this experiment started. To review pervious updates please click here.

Performance to Date:

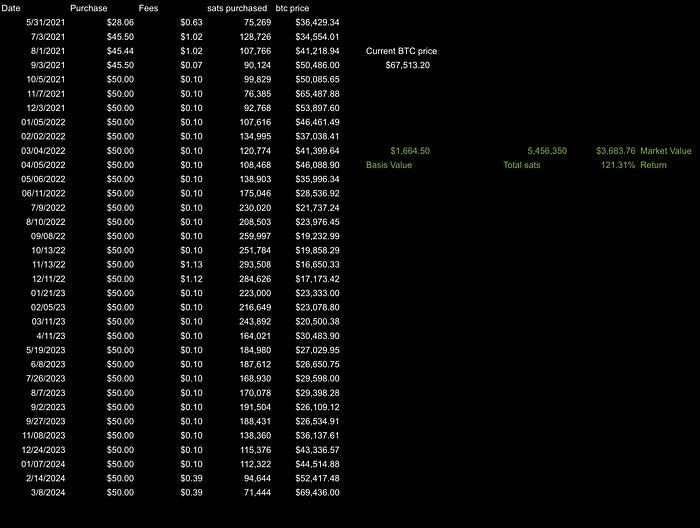

Bitcoin: $3,683.76 (121.31% Return)

🔥🔥🔥🔥ON FIRE 🔥🔥🔥🔥

The suits are here and they are pumping all of the bitcoiner bags! All the talk that the ETFs were “priced in” was absolutely wrong. Since the approval in January the Bitcoin price was on a steady march higher breaking the all time high reaching the price of $73k. Over the weekend the price dipped a little but overall the price action has been very exciting.

Just by staying humble and stacking sats the return on investment in fiat terms is about 121%!

Which is fantastic! Not only did you protect your purchasing power but you also increased it as well. This level of return beats inflation! Plus you didn’t need a financial advisor, follow the hottest YouTube finance guru, read 10-Ks to find the best stocks. Nope you could’ve skipped all that nonsense bought Bitcoin over the last 3 years and be in a nice place financially. Mind you this performance is happening in a high interest rate environment, war still going on in the Ukraine and Israel, and a US president who can barely speak coherent sentences from time to time. With Wall Street with constant buying pressure and the supply of newly minted bitcoin getting cut in half next month, the setup for a rip your nuts off bull market is all too perfect. But with all this said still must remain humble. The price can dump 80 or 90% from here based on FUD or even worse a flaw is found with the software. But even so let us rejoice! Bitcoin investing is easy anyone willing and able to save can finally do so.

Stock Advisor: $1,957.36 (21.64% Return)

Welp no surprise here. In general the the stocks that were picked by Motley Fool are for the most part doing okay. The only major miss they had is with FVRR. But the stock market has been going crazy as well as of late. Both the S&P 500 and the NASDAQ hit levels never seen before. Confidence in stocks is very strong at the moment. Plus investors are anticipating a few interest rate cuts by the end of the year which can really cause a boom for growth stocks. While the fears of a recession has died down a bit it is still a strong possibility the market can take a downturn. The CPI is still not at the target 2% the Fed wishes to hit before cuts are on the table but keeping rates this long can have damaging implications on the overall stock market. But with all that said paying for Stock Advisor and only have two stocks that losing money is still pretty impressive. Some other positions have massively underperformed the inflation and the overall market but a slight gain is better than a loss and it is much better than just sitting in cash for three years.

Conclusion

Really not much to say here. Bitcoin is clearing the better option here when it comes to investing. The Motley Fool product that I paid for picked really good stocks and gave really good return. A 21% return after three years of investing is pretty good! Before Bitcoin I would be over the moon with a return like this picking individual stocks. But the reality is here that Bitcoin does exist. And so far this experiment is showcasing just doing a simple monthly buy of Bitcoin will saving you time and stress of watching over stock portfolio. Another point to make on why buying Bitcoin is better than using Motley Fool’s product is the fact I must pay a monthly fee to continue to receive the investment advice. I am sure since I purchased the product Motley Fool has adjusted this portfolio accordingly. Added some positions sold others to make sure the companies fall into their investment parameters. But this experiment is proving ignore all that noise. Just buy bitcoin send it to a wallet where you own the keys. Live life and relax!

Now lets check on the passive index investors:

S&P 500

9/13/2021 — — — — — — — — -> 4,468.72

3/17/2024 — — — — — — — — -> 5,185.50

Return of : 16.03%

Dow Jones

9/13/2021 — — — — — — — — — -> 34,869.63

3/17/2024 — — — — — — — — — — >39,151.00

Return of: 12.27%

NASDAQ

9/13/2021 — — — — — — > 13,105.58

3/17/2024 — — — — — — -> 18,111.50

Return of : 38.1%

Well looks like the passive crowd is doing okay. No bad options for the Benjamin Graham passive investor types. If you are very risk adverse and trust the current system then using the S&P 500, and the Dow Jones would have saved your money and preserved your purchasing power. What is most impressive here is the NASDAQ going completely creamy. 38% return is nothing to sneeze at. It beat the stock advisor which one of its selling points was beating the market. Well over these last three years just buying the NASDAQ and Bitcoin would have faired better than even paying to use Motley Fool’s product. Very interesting! But still the passive crowd is getting smoked by Bitcoin. It isn’t even close but this is what happens when you have an asset that can’t be manipulated. No buy backs or stock dilutions. Price is based on simple supply and demand.

Normally I give a little bitcoin tip after posting this. Last update I used NOSTR which was a success so I will be using NOSTR going forward to hand out the tip in Sats for reading this. To prove you read the article message me the emoji I used and what total number of Sats I have purchased.

To find me on NOSTR. Enter the following public key into any NOSTR client:

npub18zc85v0nkg7maw04nh4hhmzmnych876qygsxnq8nszwsk69tl9vscy44j4

or find me by searching by NIP-05 at BlokchainB@stacker.news

A Message from InsiderFinance

Thanks for being a part of our community! Before you go:

- 👏 Clap for the story and follow the author 👉

- 📰 View more content in the InsiderFinance Wire

- 📚 Take our FREE Masterclass

- 📈 Discover Powerful Trading Tools